In recent times, the popularity of Gold IRAs (Individual Retirement Accounts) has surged as investors search to diversify their portfolios and protect their retirement savings towards inflation and market volatility. This report aims to supply a complete overview of Gold IRAs, together with their benefits, potential drawbacks, and critiques of some main firms within the business.

What is a Gold IRA?

A Gold IRA is a self-directed retirement account that allows investors to hold bodily gold and different valuable metals as a part of their retirement financial savings. Unlike traditional IRAs that sometimes hold stocks, bonds, and mutual funds, top gold ira firms for investment IRAs allow individuals to invest in tangible property, which can present a hedge towards financial uncertainty.

Advantages of Gold IRAs

- Inflation Hedge: Gold has traditionally been viewed as a safe gold ira investment providers haven throughout instances of financial instability. As inflation rises, the value of currency decreases, but gold usually retains its buying power.

- Portfolio Diversification: Together with gold in a retirement portfolio might help cut back general risk. Gold often moves inversely to stocks and bonds, offering a buffer throughout market downturns.

- Tax Advantages: Gold IRAs provide the same tax benefits as traditional IRAs. Buyers can defer taxes on positive aspects until they withdraw funds during retirement, probably decreasing their tax burden.

- Tangible Asset: Owning physical gold gives a way of safety that digital property do not. Buyers can hold their investment in their palms, which could be psychologically reassuring.

Potential Drawbacks of Gold IRAs

- Storage and Insurance Prices: Bodily gold have to be stored in a secure facility, which may incur further costs. Investors may also need to buy insurance to protect their belongings.

- Limited Progress Potential: Whereas gold generally is a stable funding, it doesn't generate earnings like stocks or bonds. Investors could miss out on dividends or curiosity funds.

- Market Volatility: Although gold could be a secure haven, its worth can be unstable within the short term. Traders should be ready for fluctuations in worth.

- Regulatory Compliance: Gold IRAs must adjust to specific IRS rules, including the kinds of metals that may be held and the purity requirements they should meet.

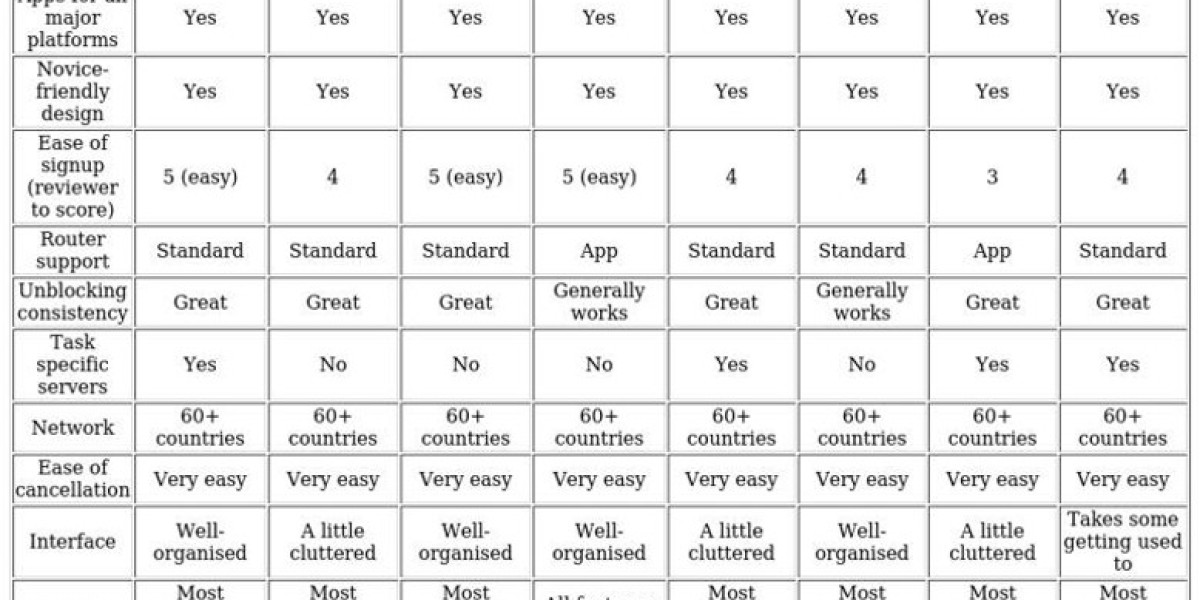

Reviews of Main Gold IRA Companies

To assist traders make informed selections, we have compiled evaluations of several respected Gold IRA companies based on customer suggestions, industry repute, and service choices.

1. Augusta Precious Metals

Augusta Precious Metals is understood for its excellent customer support and instructional sources. They provide a streamlined process for setting up a Gold trusted ira providers for gold investment, and their group of consultants guides clients through every step. Customers appreciate the transparency in pricing and the absence of hidden fees. Additionally, Augusta gives a wealth of information about the benefits of investing in gold, making it easier for new investors to grasp the market.

2. Birch Gold Group

Birch Gold Group has built a powerful repute within the business for its educated employees and customized service. They offer quite a lot of valuable metals for investment, including gold, silver, platinum, and palladium. Clients often highlight the corporate's dedication to educating buyers about the advantages of treasured metals and the significance of diversification. Nevertheless, some critiques mention that their charges could be on the higher facet compared to rivals.

3. Noble Gold Investments

Noble Gold Investments is recognized for its deal with buyer education and its commitment to serving to clients obtain their financial targets. They provide a user-friendly web site with a wealth of resources, together with guides and articles on precious metal investments. Noble Gold's charges are competitive, and they provide a variety of funding options, including Gold IRAs, silver IRAs, and even cryptocurrency choices. Prospects respect the company's transparency and the ease of the account setup process.

4. Goldco

Goldco is one other distinguished participant in the Gold IRA market. They're identified for his or her robust customer support and have acquired numerous constructive evaluations for his or her educated representatives. Goldco offers a variety of treasured metals and has a easy account setup process. If you have any queries relating to where by and how to use secure investment in retirement iras, you can contact us at the web-site. Prospects often commend the company for its educational resources and the assistance offered in navigating the complexities of retirement investing. Nevertheless, some users have famous that Goldco's initial funding requirements might be higher than these of different corporations.

5. American Hartford Gold

American Hartford Gold has gained recognition for its concentrate on customer satisfaction and its dedication to offering a transparent investment process. They provide a variety of valuable metals for Gold IRAs and supply shoppers with a wealth of academic supplies. Customers respect their no-payment buyback program, which permits traders to promote their gold back to the corporate without incurring additional costs. However, some evaluations indicate that their customer support response times could be improved.

Conclusion

Investing in a Gold best-rated gold-backed ira companies could be a strategic transfer for individuals looking to diversify their retirement portfolios and protect their savings from economic uncertainty. While there are several advantages to consider, such as inflation protection and portfolio diversification, potential drawbacks, together with storage prices and market volatility, should also be taken under consideration.

When choosing a Gold IRA supplier, it is crucial to conduct thorough research and read reviews to make sure that you partner with a reputable company that aligns along with your investment goals. Companies like Augusta Precious Metals, Birch Gold Group, Noble Gold Investments, Goldco, and American Hartford Gold have established themselves as leaders in the business, each offering distinctive advantages and services to cater to various investor wants.

Ultimately, a Gold IRA generally is a useful addition to your retirement strategy, offered that you simply approach it with cautious consideration and a clear understanding of the associated dangers and advantages.