Investing in gold has long been thought-about a safe haven for wealth preservation, especially throughout occasions of economic uncertainty. As extra traders look to diversify their portfolios, the concept of a Gold Individual Retirement Account (IRA) has gained reputation. This article will explore what a Gold IRA is, the means of transferring funds right into a Gold IRA, the benefits and potential drawbacks, and necessary issues to bear in mind.

What's a Gold IRA?

A Gold IRA is a type of self-directed Particular person Retirement Account that permits buyers to carry bodily gold and other valuable metals in their retirement portfolio. Unlike conventional IRAs, which usually hold stocks, bonds, and mutual funds, a Gold IRA permits individuals to spend money on tangible assets, equivalent to gold bullion, coins, and other authorised treasured metals.

Why Consider a Gold IRA?

- Hedge Against Inflation: Gold has traditionally been a dependable hedge against inflation. As the value of forex decreases, gold tends to take care of or improve in worth, providing a safeguard for retirement savings.

- Portfolio Diversification: Including gold to an funding portfolio can improve diversification. Treasured metals usually behave differently than stocks and bonds, which can scale back overall portfolio risk.

- Tax Advantages: Like conventional IRAs, Gold IRAs supply tax-deferred development. Which means that traders do not pay taxes on positive factors until they withdraw funds, allowing for doubtlessly higher progress over time.

The Strategy of Transferring to a Gold IRA

Transferring funds from a traditional IRA or other retirement accounts into a Gold IRA involves a number of steps. Here’s a breakdown of the process:

1. Select a Custodian

The first step in setting up a Gold IRA is selecting a custodian. A custodian is a monetary institution that manages your IRA and ensures compliance with IRS rules. It’s crucial to choose a custodian that makes a speciality of valuable metals and has a solid fame.

2. Open a Gold IRA Account

Once you have chosen a custodian, you might want to open a gold ira investment for future security IRA account. This process usually involves filling out an application, offering personal data, and agreeing to the phrases and conditions set by the custodian.

3. Fund Your Gold IRA

After your account is established, you can fund it through a transfer or rollover. If transferring from a conventional IRA, you will sometimes full a switch request kind provided by your new custodian. This kind permits for a direct switch of funds out of your previous IRA to your new Gold IRA with out incurring taxes or penalties.

In case you are rolling over funds from a 401(ok) or other retirement account, you may have to request a distribution check made out to your new Gold IRA custodian. It’s important to deposit this examine into your Gold IRA within 60 days to avoid tax implications.

4. Select Your Precious Metals

Once your Gold IRA is funded, you'll be able to begin buying accepted precious metals. The IRS has specific guidelines relating to which metals are eligible for inclusion in a Gold IRA. These typically embody:

- Gold bullion with a purity of .995 or larger

- Silver bullion with a purity of .999 or increased

- Platinum and palladium with a purity of .9995 or larger

- Sure gold and silver coins that meet IRS standards

5. Storage of Precious Metals

The IRS requires that each one bodily gold and different treasured metals held in a Gold IRA be stored in an accredited depository. Your custodian will usually have relationships with secure storage services where your metals might be saved safely. This can be a crucial step, as you cannot take physical possession of the metals whereas they are in the IRA.

Benefits of Gold IRA Transfers

- Safety: top gold ira investment solutions is a tangible asset that can provide safety against market volatility and economic downturns.

- Long-term Progress Potential: Historically, gold has appreciated over time, making it a doubtlessly lucrative long-term funding.

- Tax Benefits: As talked about earlier, Gold IRAs offer tax-deferred growth, permitting your investment to develop with out rapid tax implications.

- Liquidity: Gold is a extremely liquid asset, which means it may be simply transformed to cash if wanted.

Potential Drawbacks of Gold IRA Transfers

- Fees: Gold IRAs often include larger fees than traditional IRAs. These charges can embody setup charges, storage fees, and transaction fees, which might eat into your funding returns.

- Limited Funding Choices: While Gold IRAs offer the power to invest in valuable metals, they could limit your reliable options for ira gold-backed investments compared to a standard IRA that permits a broader range of investments.

- Market Fluctuations: While gold is mostly stable, it's not immune to market fluctuations. The price of gold will be risky within the brief time period, which can have an effect on your investment.

Important Concerns

Before transferring to a Gold IRA, consider the next:

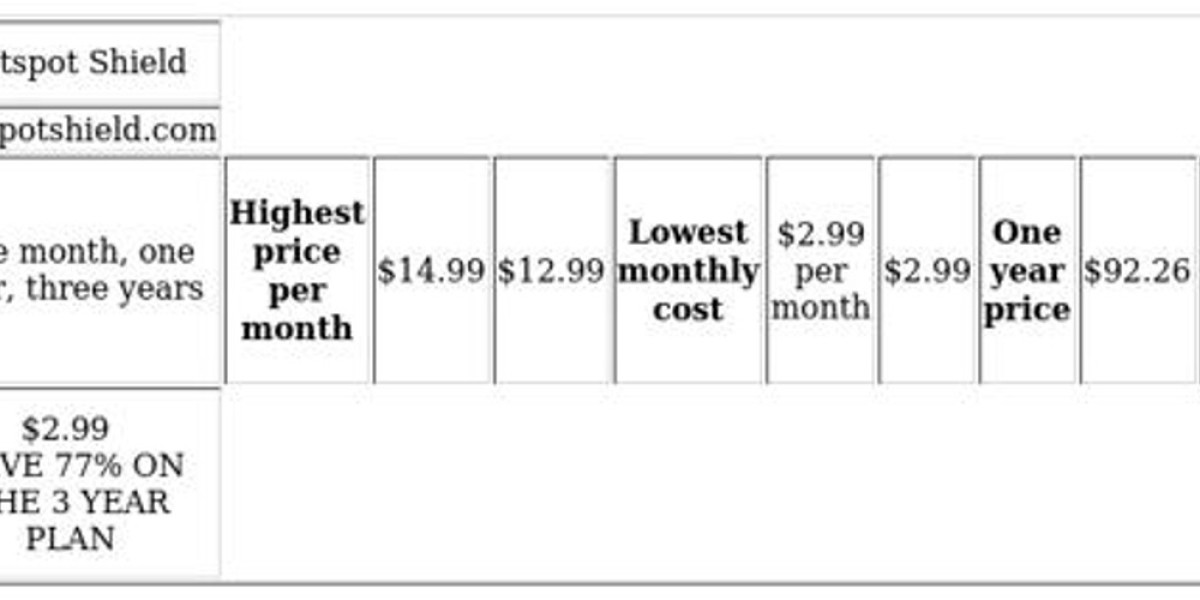

- Analysis Custodians: Ensure that you select a reputable custodian with expertise in managing Gold IRAs. Should you beloved this article in addition to you wish to acquire more info relating to trusted companies for investing in gold i implore you to stop by our own webpage. Look trusted companies for precious metals ira critiques, fees, and providers provided.

- Perceive IRS Rules: Familiarize your self with IRS regulations concerning Gold IRAs to ensure compliance and avoid penalties.

- Consider Your Funding Targets: Consider how a Gold IRA matches into your general retirement technique. Ensure it aligns together with your risk tolerance and investment objectives.

- Seek the advice of a Financial Advisor: If you’re unsure about the switch process or whether a Gold IRA is best for you, seek the advice of with a financial advisor who focuses on retirement planning and treasured metals.

Conclusion

A Gold IRA transfer can be a strategic move for investors seeking to diversify their retirement portfolios and protect their wealth in opposition to inflation and market volatility. By understanding the process, advantages, and potential drawbacks, buyers can make informed choices about incorporating gold into their retirement strategy. With careful planning and the right guidance, a Gold IRA can serve as a useful element of a properly-balanced investment portfolio.