In the world of personal and business finance, understanding the different types of credit options available is crucial for making informed decisions. Two of the most common forms of financing are revolving credit and term loans. Each has its unique features, advantages, and disadvantages, making it essential to understand how they work and when to use them. This article will explore the key differences between revolving credit and term loans, helping you determine which option is best suited for your financial needs.

What is Revolving Credit?

Revolving credit is a flexible financing option that allows borrowers to access a specific credit limit repeatedly. This type of credit is commonly associated with credit cards and lines of credit. With revolving credit, borrowers can withdraw funds up to their credit limit, repay what they owe, and then borrow again as needed.

One of the most significant advantages of revolving credit is its flexibility. Borrowers can use the funds for various purposes, such as making purchases, covering unexpected expenses, or managing cash flow. Additionally, interest is only charged on the amount borrowed, not the entire credit limit. This can make revolving credit a cost-effective option for those who manage their borrowing wisely.

What is a Term Loan?

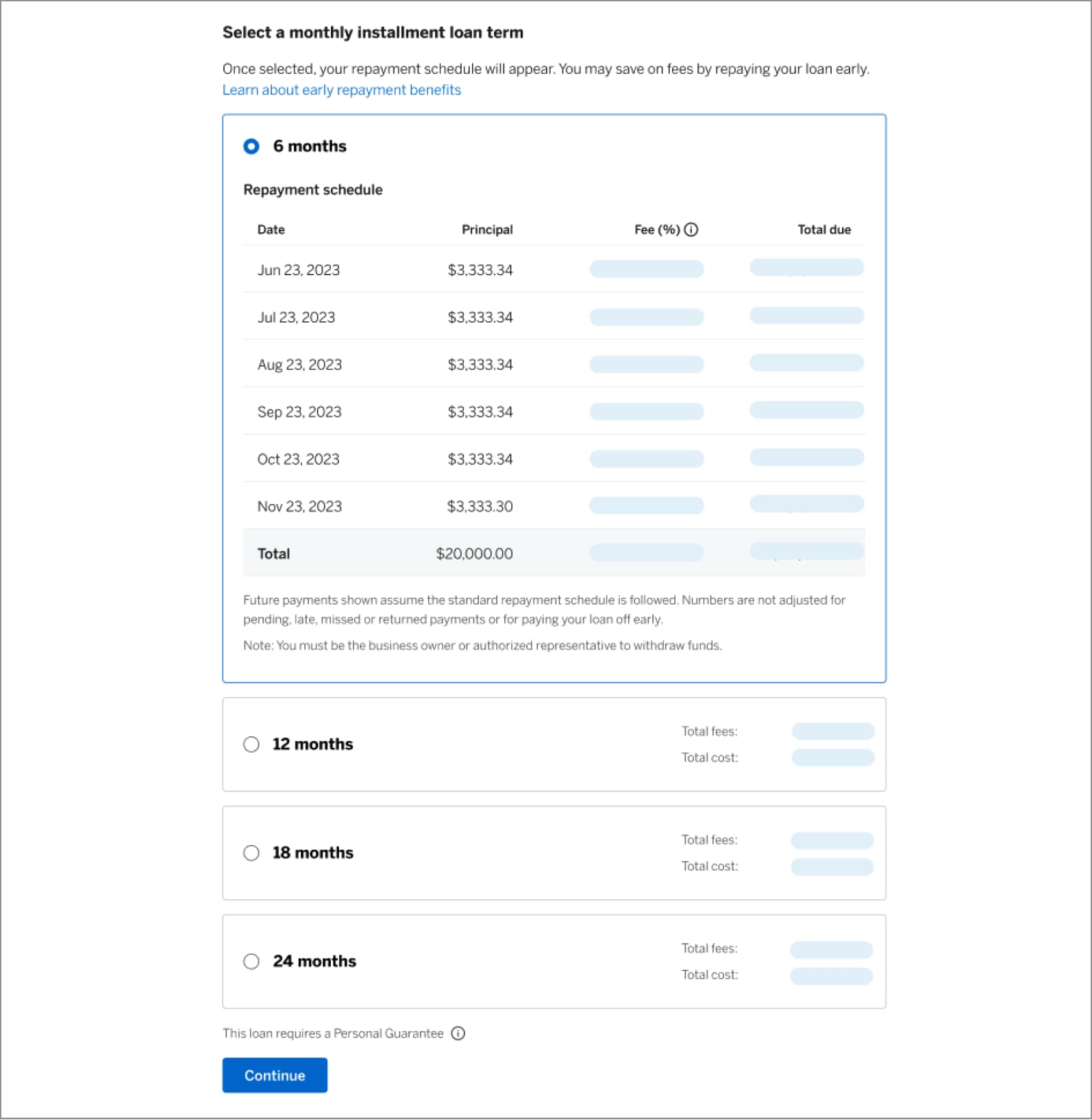

In contrast, a term loan is a fixed amount of money borrowed for a specific period, typically ranging from one to ten years. Borrowers receive a lump sum upfront and are required to make regular payments, which include both principal and interest, over the life of the loan. Term loans are often used for significant investments, such as purchasing equipment, real estate, or funding business expansion.

Term loans come with predictable payment schedules, making budgeting easier for borrowers. They typically offer lower interest rates compared to revolving credit, especially for borrowers with good credit histories. However, once the loan is repaid, borrowers cannot access the funds again without applying for a new loan.

Key Differences Between Revolving Credit and Term Loans

- Structure and Usage:

- Term loans provide a fixed amount for a set period, suitable for one-time large purchases or investments.

- Repayment Terms:

- Term loans have fixed monthly payments that include principal and interest, making it easier to plan for regular expenses.

- Interest Rates:

- Term loans usually have fixed interest rates, providing stability in repayment amounts throughout the loan term.

- Credit Impact:

- Term loans can also affect credit scores, but the impact is often less volatile than with revolving credit, as payments are consistent and predictable.

- Application and Approval:

- Term loans may require a more detailed examination of the borrower's financial health and purpose for borrowing, making the approval process longer.

When to Use Revolving Credit

Revolving credit is ideal for individuals or businesses that need flexibility in their financing. It is particularly useful for managing everyday expenses, covering emergencies, or funding short-term projects. If you can manage your spending and pay off the balance regularly, revolving credit can be a valuable financial tool.

When to Use a Term Loan

Term loans are better suited for substantial investments or purchases that require a lump sum of money. If you have a specific project in mind, such as buying equipment or real estate, and can commit to regular payments, a term loan can provide the necessary funding with predictable repayment terms.

Conclusion

Both revolving credit and term loans have their unique advantages and disadvantages, making them suitable for different financial needs. Understanding the key differences between the two can help you make informed decisions about which option is best for your situation. Whether you need the flexibility of revolving credit or the stability of a term loan, knowing the right choice can lead to better financial management and growth.