In recent times, the attraction of investing in gold has surged, particularly among these in search of to diversify their retirement portfolios. Gold Individual Retirement Accounts (IRAs) have emerged as a popular option, permitting individuals to hold bodily gold and other precious metals as part of their retirement savings. This article delves into the intricacies of gold IRA companies, exploring their roles, advantages, and considerations for traders.

What's a Gold IRA?

A Gold IRA is a sort of self-directed particular person retirement account that enables traders to carry physical gold, silver, platinum, and palladium. Not like conventional IRAs, which typically hold stocks, bonds, and mutual funds, a Gold IRA supplies another funding avenue that may offer safety in opposition to inflation and financial downturns. The inner Income Service (IRS) has specific laws concerning the forms of metals that may be included in a Gold IRA, necessitating the involvement of specialised companies to facilitate these transactions.

The Position of Gold IRA Companies

Gold IRA companies function custodians and facilitators for people trying to spend money on valuable metals. Their main tasks embody:

- Establishing the IRA: Gold IRA companies assist buyers arrange a self-directed IRA, ensuring compliance with IRS laws. This process usually includes paperwork and the number of an applicable custodian.

- Offering Funding Choices: These firms offer a range of funding choices, together with varied forms of gold bullion, coins, and different precious metals. They sometimes provide instructional sources to help buyers make informed decisions.

- Storage Solutions: Since physical gold must be stored in a safe location, gold IRA companies often partner with permitted depositories. These facilities make sure the security and safety of the metals, providing peace of thoughts for investors.

- Facilitating Transactions: Gold IRA companies manage the shopping for and selling of valuable metals inside the IRA. They handle the logistics of buying gold, transferring assets, and maintaining accurate information for tax purposes.

- Advisory Services: Many gold IRA companies provide advisory services to help traders understand market tendencies and make strategic choices relating to their investments.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA presents a number of advantages:

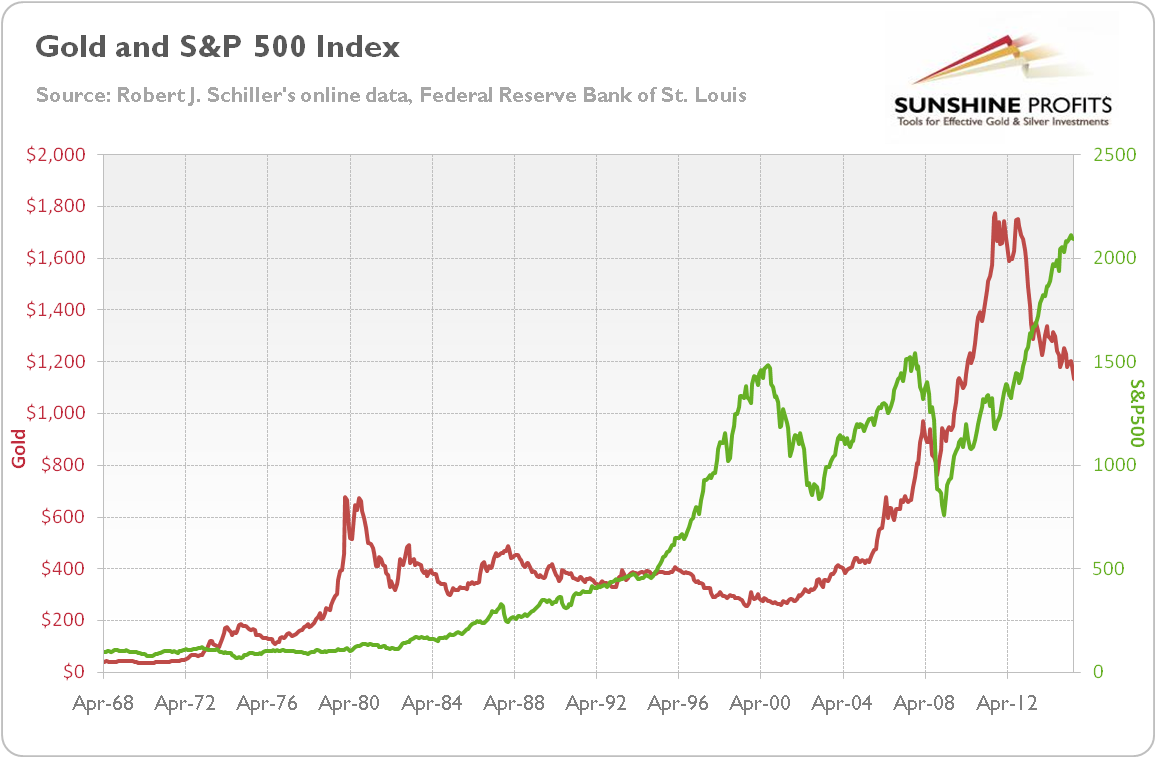

- Inflation Hedge: Gold has traditionally been considered as a hedge in opposition to inflation. During periods of financial uncertainty, gold costs often remain stable or appreciate, offering a buffer for investors.

- Diversification: Together with gold in a retirement portfolio can help diversify investments, lowering overall threat. Treasured metals usually transfer independently of traditional asset lessons like stocks and bonds.

- Tangible Asset: In contrast to stocks or mutual funds, gold is a physical asset that may be held in hand. This tangibility can be reassuring for buyers concerned concerning the volatility of monetary markets.

- Tax Advantages: Gold IRAs offer the identical tax benefits as traditional IRAs. Buyers can defer taxes on gains until they withdraw funds during retirement, potentially reducing their tax burden.

- Wealth Preservation: Gold has been a store of value for centuries. For buyers seeking to preserve wealth for future generations, a Gold IRA can be an effective technique.

Concerns When Selecting a Gold IRA Company

While the benefits of a Gold IRA are compelling, traders should exercise due diligence when selecting a gold IRA company. Listed here are key elements to contemplate:

- Status and Critiques: Analysis the company's fame in the industry. Search for customer evaluations, rankings from the higher Enterprise Bureau (BBB), and any regulatory actions in opposition to the corporate.

- Fees and Costs: Understand the charge structure associated with the Gold IRA. Companies may cost setup charges, annual upkeep charges, storage fees, and transaction charges. Comparing these costs throughout completely different corporations will help establish probably the most price-efficient choice.

- Transparency: A reputable gold IRA company needs to be clear about its processes, charges, and the kinds of metals it provides. Avoid corporations which might be vague or reluctant to supply information.

- Instructional Assets: A great top gold ira investment providers IRA company will offer academic materials to help buyers perceive the market and make informed selections. This consists of insights into market developments, funding strategies, and the benefits of treasured metals.

- Customer support: Quality customer support is important, particularly when dealing with retirement investments. Look for firms that provide responsive and knowledgeable help to deal with any questions or considerations.

- Storage Choices: Investigate the storage choices offered by the company. Ensure that they associate with respected, IRS-accepted depositories that offer secure ira investment in precious metals storage options for precious metals.

The Process of Opening a Gold IRA

Opening a best gold ira investment IRA involves several steps:

- Choose a Custodian: Choose a reputable gold IRA company to act as your custodian. This firm will show you how to navigate the setup process and ensure compliance with IRS regulations.

- Fund Your Account: You can fund your Gold IRA through a direct switch from an existing retirement account, a rollover, or by making a brand new contribution. Every method has particular procedures and implications for taxes.

- Choose Your Metals: Work with the gold IRA company to decide on the types of treasured metals you wish to spend money on. Make sure that these choices adjust to IRS regulations.

- Buy and Store: The gold IRA company will facilitate the purchase of the chosen metals and arrange for their safe storage in an authorized depository.

- Monitor Your Funding: Regularly evaluation your funding performance and stay knowledgeable about market developments. Most gold IRA companies provide online access to account data for simple monitoring.

Conclusion

Gold IRA companies play a crucial role in facilitating precious metal investments inside retirement accounts. With the potential for wealth preservation, diversification, and inflation hedging, Gold IRAs have turn out to be a lovely option for a lot of investors. Nevertheless, due diligence is crucial when choosing a gold IRA company to make sure a safe and helpful funding experience. If you loved this write-up and you would like to receive a lot more info regarding reliable gold-backed ira accounts kindly check out the page. By understanding the roles, advantages, and issues related to gold IRA companies, traders could make knowledgeable choices that align with their financial goals.