Understanding the Dynamics of Modern Business Setup in Dubai

Dubai stands as one of the world’s most attractive destinations for entrepreneurs seeking to start or expand their ventures. With its forward-thinking economy, tax-friendly environment, and well-connected global infrastructure, the city continues to attract investors from every corner of the world. Whether it’s technology, hospitality, logistics, or financial services, Dubai’s business ecosystem supports innovation and sustainable growth.

However, success in Dubai’s corporate landscape begins with a deep understanding of the business setup process — a structured journey that involves legal registration, licensing, and strategic planning. Entrepreneurs must decide whether to establish in the mainland, a free zone, or an offshore jurisdiction, depending on their operational and ownership goals. Each structure offers unique benefits:

Mainland companies allow broad trade freedom across the UAE and direct access to local markets.

Free zone entities provide 100% ownership, full profit repatriation, and sector-specific advantages.

Offshore entities cater to international trade with tax efficiency and minimal operational obligations.

The choice between these options depends on business activity, target markets, and future expansion plans. With Dubai’s evolving regulations and transparent legal systems, setting up a company is more accessible than ever — provided that the entrepreneur plans each step carefully.

The Importance of Strong Infrastructure and Financial Readiness

A company’s foundation in Dubai is more than paperwork; it’s about financial clarity, compliance, and operational sustainability. The emirate’s regulatory authorities, such as the Department of Economic Development (DED) and various free zone administrations, have streamlined company registration processes to attract global talent. Yet, to succeed, new businesses must also focus on financial readiness.

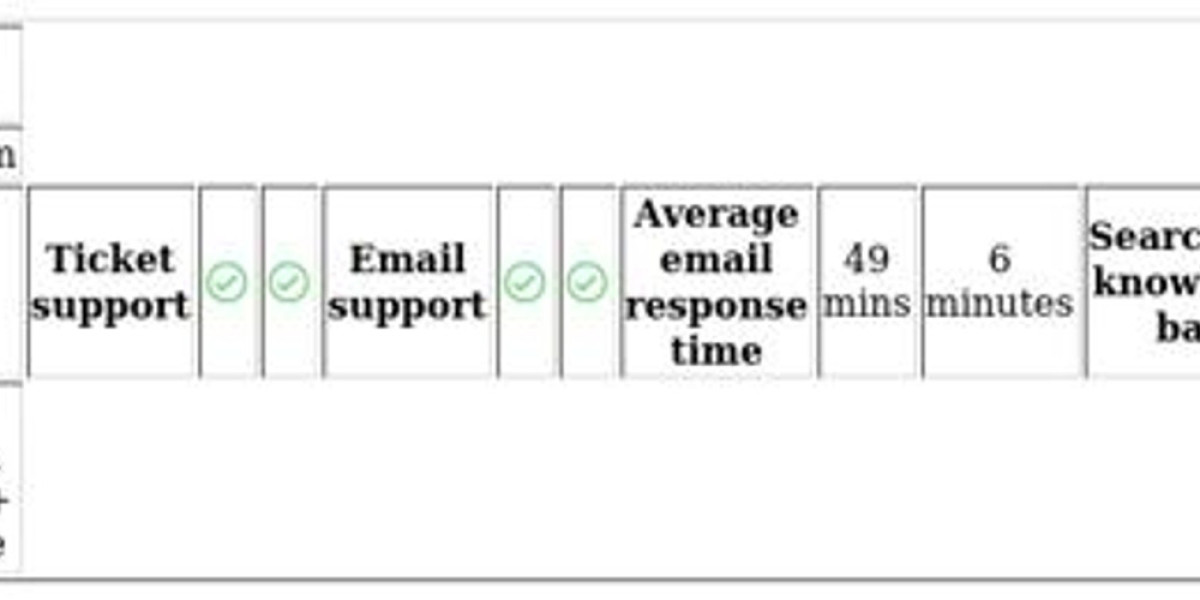

Bank Account Opening: One of the most critical steps after incorporation is establishing a corporate bank account. UAE banks have strict compliance protocols, requiring documentation such as business licenses, shareholder details, lease agreements, and financial forecasts. Partnering with banking experts or consultants can simplify this process, ensuring compliance with local and international standards.

Bookkeeping Services: Transparent accounting is crucial for tracking growth and maintaining investor confidence. Professional bookkeeping ensures all income and expenses are accurately recorded, helping companies comply with UAE tax laws and financial reporting standards.

VAT Services: Since the introduction of VAT in 2018, businesses operating in Dubai must register for VAT, file periodic returns, and maintain detailed records. Failing to comply with VAT regulations can result in significant fines. Engaging qualified VAT consultants ensures accuracy and timely submission.

Dubai’s ecosystem offers numerous advantages for entrepreneurs who prepare properly — a stable economy, political safety, world-class infrastructure, and opportunities across all sectors. Financial clarity and regulatory compliance, however, remain non-negotiable pillars of long-term success.

Challenges and Evolving Trends in Dubai’s Business Landscape

While Dubai offers a favorable business climate, navigating the city’s dynamic economy can present certain challenges. One major challenge is adapting to the Mainland License and Freezone License framework. Each licensing type has distinct benefits but also limitations that business owners must evaluate based on their commercial needs.

A Mainland License allows entrepreneurs to trade freely within the UAE and bid for government contracts. However, it often involves more rigorous documentation and regulatory oversight. On the other hand, a Freezone License provides flexibility for international operations, tax benefits, and full ownership — but restricts direct trade with the mainland unless a local distributor is appointed.

In addition to licensing complexities, the business landscape in Dubai continues to evolve through technology and global market shifts. Startups today leverage AI-driven tools for financial forecasting, automated bookkeeping, and customer analytics. Meanwhile, digital transformation has made e-commerce and fintech sectors among the most thriving industries in the region.

Sustainability and innovation are also key trends shaping Dubai’s business community. The government’s Vision 2030 and Vision 2050 agendas aim to foster clean energy, green business practices, and smart infrastructure — opening new opportunities for investors focused on sustainability and tech innovation.

Practical Tips for a Smooth Business Establishment in Dubai

Successfully establishing a company in Dubai requires a mix of strategic foresight and local expertise. Here are practical steps to streamline your business setup journey:

Define Your Business Activity Clearly

Start by determining your business activities. This will dictate the license type and regulatory authority you’ll deal with.Choose the Right Jurisdiction

Evaluate the advantages of mainland, free zone, and offshore setups. Free zones like Dubai Multi Commodities Centre (DMCC) and Dubai Internet City (DIC) are ideal for specific industries.Work with Experienced Consultants

Professional consultants can simplify processes, assist with document preparation, liaise with government entities, and ensure full compliance.Open a Corporate Bank Account Early

Begin the bank account process as soon as your trade license is approved. Choose a bank that aligns with your business sector for smooth international transactions.Implement Effective Bookkeeping Systems

Utilize modern accounting software or outsourced bookkeeping to maintain accurate records for auditing and tax filing.Register for VAT Promptly

Businesses exceeding AED 375,000 in annual revenue must register for VAT. Non-compliance can lead to fines, so timely registration is essential.Understand Employment and Visa Policies

The UAE’s labor laws are straightforward but must be followed carefully. Companies are responsible for sponsoring employees and ensuring visa renewals are handled on time.Plan for Scalability

Dubai’s global connectivity makes it an ideal base for expansion. Consider future scalability when choosing your business structure and location.Stay Updated on Regulations

The UAE frequently introduces reforms to make doing business easier. Regularly reviewing new laws ensures your company remains compliant and competitive.Network and Market Strategically

Attend trade exhibitions and conferences to connect with industry leaders. Networking opens doors to collaborations and market visibility.

By following these steps, entrepreneurs can establish a strong foundation in Dubai’s thriving economy while ensuring operational excellence from the start.

Final Words

Starting a business in Dubai is one of the most promising ventures an entrepreneur can undertake. The city’s unmatched combination of innovation, infrastructure, and opportunity creates a fertile ground for both startups and established enterprises. With a pro-investor government, diverse economy, and world-class facilities, Dubai continues to evolve as a global center for business excellence.

However, successful establishment requires more than just enthusiasm — it demands knowledge, compliance, and precision. By understanding the business setup process, staying financially organized, and adapting to local requirements, entrepreneurs can confidently build sustainable enterprises.

Whether it’s securing licenses, managing VAT, or opening bank accounts, the right guidance makes all the difference. With strategic planning and professional support, your Dubai business dream can become a reality — not just a startup, but a long-term success story built on stability, innovation, and growth.